Accounting

The accounting is managed internally by graduate accountants in order to ensure it always complies with Portuguese corporate and tax law. The tariff range is from € 180 to € 250 per month.

- Administrative management.

- Accounting management.

- Preparing your payrols.

- VAT tax return.

- Social Security return.

- Closing annual accounts.

Companies Taxes

The equivalent to a SARL in France, a LDA company bears a tax of 21% and a 23% VAT.

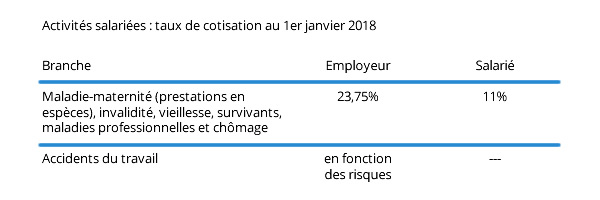

Social Charges at Portugal

Social Charges (Social Security) 23.75% Employer + 11% Employee (salary part).

Minimum salary of an employee is € 590 (01/2015) for legal schedule of 39 working hou

Our Services

Company Creation

The formula we offer allows you to create in 2 hours a Portuguese limited liability company, operational the same day, with a capital deposit of 1€, bank accounts, and possibility of obtaining the intra-community number the same day, and this , without obligation of residence in Portugal.

Bank Account

For many years we have been working with all the largest Portuguese banks, we will help you find the one that best suits your needs and your activity and can advise you on the future of your business and its needs.

Domiciliation

Domiciliation is a key about the trust and credibility of your company. Domiciling your company at our Business Centre allows you to have an address in Lisbon centre.

Accounting

The accounting is managed internally by graduate accountants in order to ensure it always complies with Portuguese corporate and tax law. The tariff range is from € 180 to € 250 per month.

Needing advice?

Contact Us

Please note that our emails could get into the spams folder. Please be kind enough to check.

Groupe V.S.E.E. SL.

Rua Da Páscua, N·7 – R/C

1250-177 Lisboa, Portugal

Contact our experts francofonos:

00 351 215553629

Company in Spain:

Calle Tuset 20/24 – 8º 8ª

Barcelona 08006 SPAIN

creer-societe-espagne.com

Company in Andorra:

Av. Consell De La Terra 19

AD700 - Escaldes Engordany

Principat D'Andorra

societeandorre.com